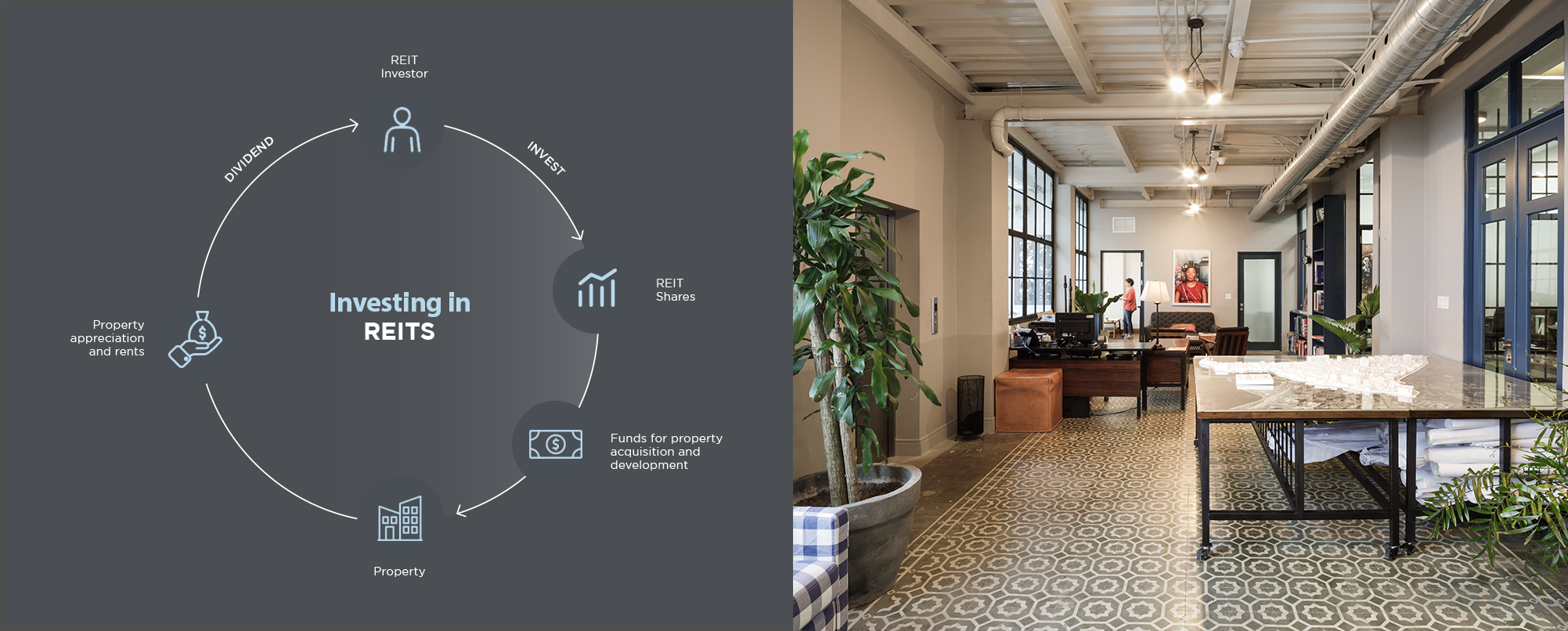

Income + appreciation

Performance based on real assets that

act as inflation hedge.

Operational and

tax efficiency

Easier than owning traditional real estate.

Liquidity and transparency

Listed fund, providing higher liquidity than traditional real estate investment

Portfolio

diversification

Exposure to real estate investments, differentiated correlation to traditional investment assets (bonds, stocks)

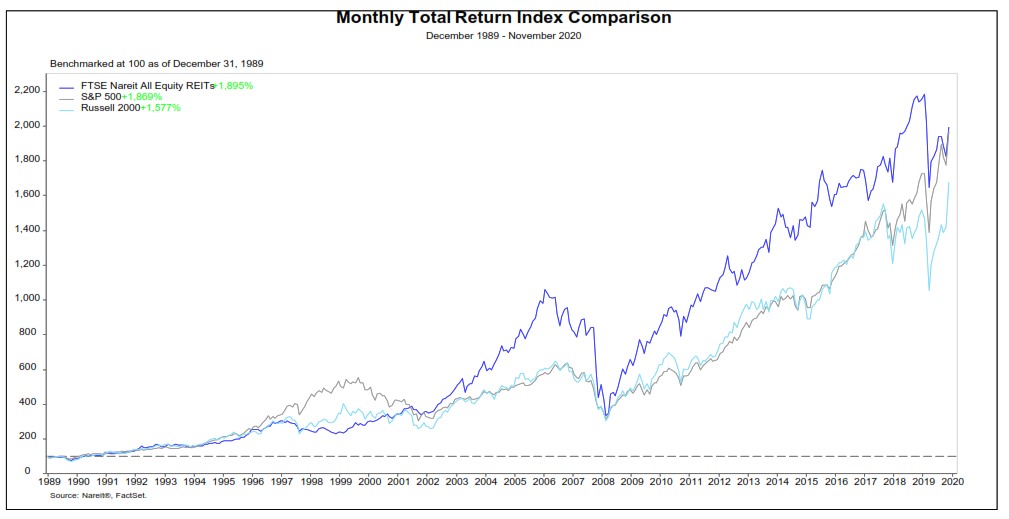

REITs Tend to Outperform Traditional Investments

REIT Dividend yield vs. 10 Year Constant Maturity Treasury Yield

January 1990 – November 2020

Monthly Total Return Index Comparison

December 1989 – November 2020